—Chamath Palihapitiya (@chamath) February 3, 2021 And for a few hours, the anxieties of making it through a pandemic faded away. Palihapitiya's thirst trap was all anyone — or at least members of. CNBC's 'Halftime Report' team is joined by Chamath Palihapitiya, CEO of Social Capital, to discuss how he traded GameStop and what he thinks this means for t.

© Brian Ach/Getty Images for TechCrunch Billionaire Chamath Palihapitiya. Brian Ach/Getty Images for TechCrunch- Palihapitiya said the problem is not just isolated to Russia-backed ads and the 2016 presidential election, which led officials from Facebook, Twitter and Google to.The former Facebook executive.

- Chamath Palihapitiya is a Canadian-American venture capitalist and the founder and CEO of Social Capital. @Chamath on Twitter SPAC Involvement Current IPOB IPOC FVAC (Anchor to the PIPE) Past: Virgin Galactic.

- Chamath Palihapitiya sat down with Bloomberg on Friday to discuss a wide variety of topics.

- The Social Capital founder said, 'Nobody's going to listen to Warren Buffett. There have to be some other folks that take that mantle.'

- The billionaire also touched on the SPAC boom, cryptocurrencies, and even a big tech breakup. Detailed below are his 10 best quotes.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Billionaire Chamath Palihapitiya sat down with Bloomberg on Friday to discuss everything from Warren Buffett to cryptocurrencies in a whirlwind interview.

As a leader in the ongoing SPAC surge and Reddit trader movement, the founder of the VC firm Social Capital has been the talk of the markets lately.

Palihapitiya fashions himself as a figurehead of the times, arguing that titans like Warren Buffett no longer have the energy nor the lexicon to lead the markets as they have for decades.

His thoughtful critiques of market trends, issues, and participants have made him a regular on all the major market news networks. But it's Palihapitiya's modern takes and social media prowess that have allowed him to connect with the general public, growing his fame.

To learn a little bit more about what the billionaire former Facebook man has to say about all things markets, we've put together the top 10 quotes from his interview on Friday.

On Warren Buffett:

1. 'Nobody's going to listen to Buffett. Buffett doesn't have the energy to say what he said 30 and 40 years ago in 2021. And that's OK, he's basically earned the right to chill out and be the GOAT, but there have to be some other folks that take that mantle, take the baton and do it as well to this younger generation in the language they understand.'

Read more:I was addicted to Robinhood and Wall Street Bets. I spiraled out of control, wiped out my $70,000 savings, and contemplated suicide. Here's my message to Robinhood and new investors.

On Twitter being his preferred platform

2. 'I am is a byproduct of my generation and media culture, which is faceted. Not always great facets, but multifaceted. And so you have to speak in the language of the times in order to get your point across.'

Gallery: Stocks To Keep in Your Portfolio for the Next 30 Years (GOBankingRates)

On the GameStop saga, hedge funds, and short-selling:

3. 'I doubt that, in the end, in the final analysis, that there was any collusion of any kind. But just the stench of this whole thing just goes to show you how difficult it is for normal everyday folks to have access to any kind of return. So if we break down the capitalist philosophy, they are just fundamentally stuck in this cul-de-sac of always being labor. And always being sort of at the ownership of capital, of the ownership class.'

4. 'I still think hedge funds will do well. I still think that there are some folks who are incredibly talented who will make just a ton of money for themselves and their investors. But I think disclosure needs to go up.'

5. 'In terms of short-selling, I buy the fact that it's an important part of the market. I'm not a huge fan of it. I do think that certain folks really use it to run a neutral strategy, and ya know, I think that that's great. But I also think that now, in the world of social media, and we've seen this recently, disinformation can be used to not just cause political damage, but disinformation can also cause economic damage. And so, I think that the SEC is going to have to deal with that issue and figure that out.'

Read more:Cathie Wood and her analysts discuss why Tesla's $1.5 billion bitcoin purchase could trigger a wave of corporate investments, the fallout of the GameStop-AMC phenomenon, and their bullish views on the Chinese stock behind Clubhouse

On SPACs

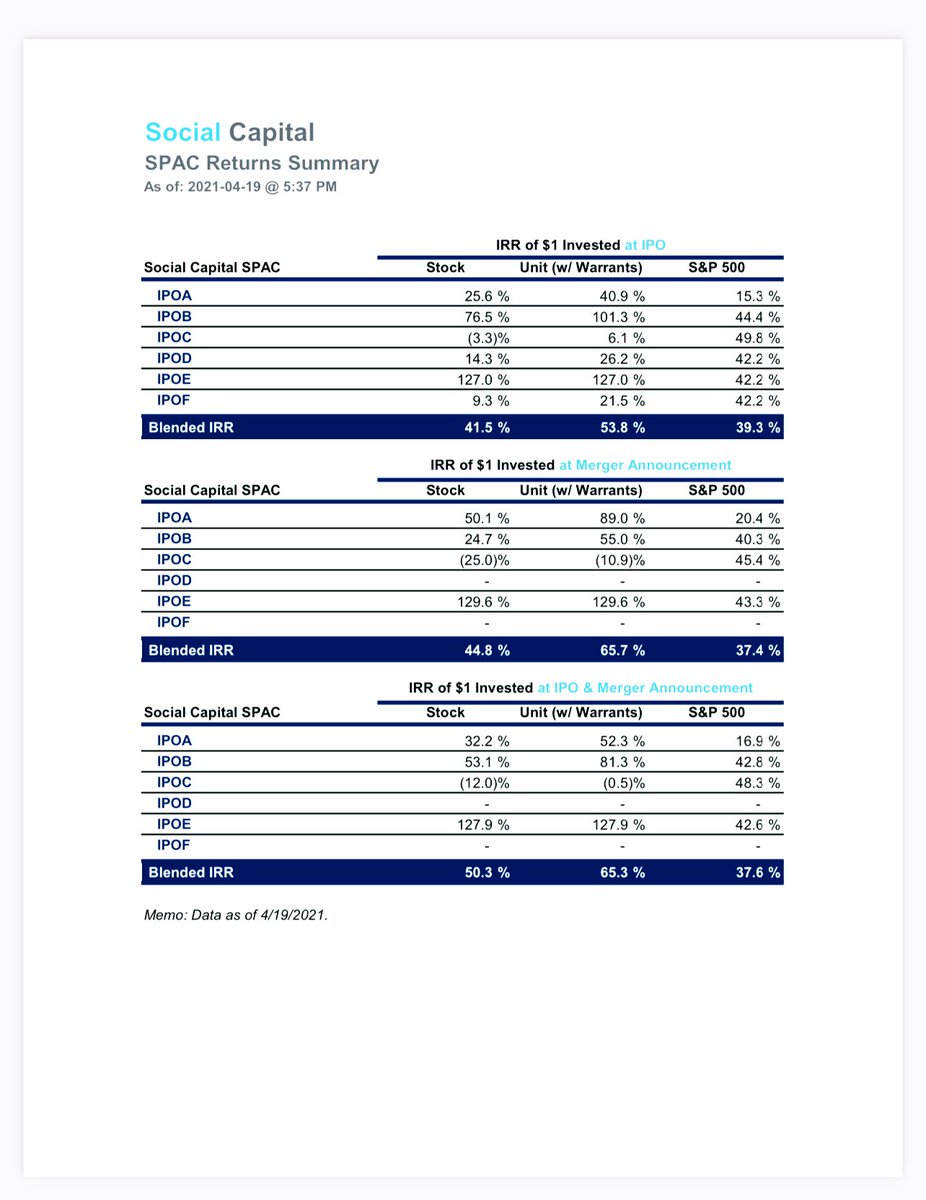

6. 'I think that SPACs are very much here to stay. Using the language of inequality, it evens the playing field. It democratizes access to high growth companies. How? Because it allows retail and it allows long-tail institutional investors. Folks that might not have necessarily been tier one hedge funds, now they can also play.'

7. 'When I used to manage institutional capital in early-stage investing, I charged a 30% carry, no hurdle, no nothing. And people were willing to be that I could generate returns, and I have, you know, 30-plus percent over the last decade, that justified a 30% carry. Similarly, here on the deals that I do, I take a 20% carry. And I think that I can find targets and opportunities that will make that more than reasonable in the final analysis.'

On cryptocurrencies

8. 'I am building a fairly sizeable portfolio of what are called NFTs, non-fungible tokens, some digital art, some virtual trading cards, and these may sound crazy to some, but I do think that that's the next frontier of digital currency and digital assets. So I have been building a portfolio.'

On a big tech breakup

9. 'Well, I think they need to get regulated. I think that companies like Facebook and Google will be subject to much stricter laws. Section 230 will change and recognize them as quasi-publishers.'

10. 'For Microsoft, Apple, and Amazon, I don't think much is going to happen. The reason is because I think that those guys are generally on the right side of history, and they generally don't err towards the type of hot button issues that politicians care about. Facebook and Google threaten the institutionalized structures of power and influence that codify politics. Amazon Prime doesn't do that.'

Read more:Goldman Sachs identifies the 25 stocks that short-sellers piled the most bearish bets upon even as Reddit traders squeezed out Wall Street

CNBC's Jim Cramer has been bashing SPACs on Twitter and his show this week. That drew attention from the so-called SPAC King Chamath Palihapitiya.

What Happened: Cramer recently highlighted Spartan Energy Acquisition (NYSE: SPAQ), a SPAC merging with Fisker. Cramer compared Henrik Fisker and his company to Nikola (NYSE: NKLA) and Trevor Milton, the Nikola founder who resigned.

On Wednesday, Cramer told his 1.4 million Twitter followers “I am sick of SPACs!.” A simple response came from Palihapitiya:

Why?

— Chamath Palihapitiya (@chamath) October 1, 2020

Cramer’s Thoughts On SPACs: Cramer tweeted to “Squawk Box” host Andrew Ross Sorkin, “Why do investors think that every SPAC is a winner.” Cramer got the following response from Sorkin:

I don’t understand it. But here is one thought: For many investors in a SPAC, pre-merger, it is simply an arbitrage, financial engineering play: they borrow money to invest and capture the spread when a deal gets announced.

— Andrew Ross Sorkin (@andrewrsorkin) October 1, 2020

Cramer went on to say that SPACs make his job hard “because I have to learn each one and there are so many of them.” He said there is “massive homework” needed on SPACs.

Cramer took the SPAC market further by comparing the risks of SPACs to the 2000 dot-com bubble:

It's really amusing that, like in 2000, i tried so hard for people to see the risks because i wanted them to stay in the market but in more staid conservative ways. Here i am again, recommending some specs but also some solid American companies and there's no place for that here

— Jim Cramer (@jimcramer) October 1, 2020

He later admitted the SPAC market is difficult to learn:

Last word on SPAC's; i am actually honest enough to admit that it is difficult to learn all of these. I hate SPACs like i hate doing homework. I do it but it's hard and it's difficult to know what a person is going to do with the money. But there is no mercy for honesty

— Jim Cramer (@jimcramer) October 1, 2020

Chamath Chimes In: Palihapitiya noticed the question Cramer posed to Sorkin and shared his thoughts:

I’d offer this:

1) It’s not so easy: not all deal announcements go well - several of these right now.

2) Sponsors decide initial spac allocations. I personally decide every allocation.

It’s important to construct initial owners who are skilled, long term investors. Arbs suck.

— Chamath Palihapitiya (@chamath) October 1, 2020

Palihapitiya recently shared his thoughts at the Benzinga Boot Camp offering up the bull and bear case.

Chamath Palihapitiya Portfolio

“It unlocks access to growth companies to a broad cohort of people that were otherwise shut out,” Palihapitiya said.

He cautioned that the SPAC process is hard and investors need to believe in the management team. He cited his “skin in the game” of personally investing in the deals his company completes. Palihapitiya said investors are betting on the decision making and access that the management team has.

What’s Next: Cramer is teasing that SPAC people will love his “Mad Money” show Thursday night. We will see if that means discussion on SPACs or a special guest to discuss the sector. Maybe Palihapitiya is ready to set the record straight.

Palihapitiya’s Social Capital Hedosophia II (NYSE: IPOB) is set to merge with Opendoor. Social Capital Hedosophia III (NYSE: IPOC) is actively searching for a target company. Palihapitiya’s next three SPACS IPOD, IPOE and IPOF are getting close to debuting.

Photo courtesy of Tulane University.

Social Capital Spac

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.